Investment Funds

Third-party investment funds

Enjoy a wide range of investment funds managed by different management entities and decide how you want to invest.

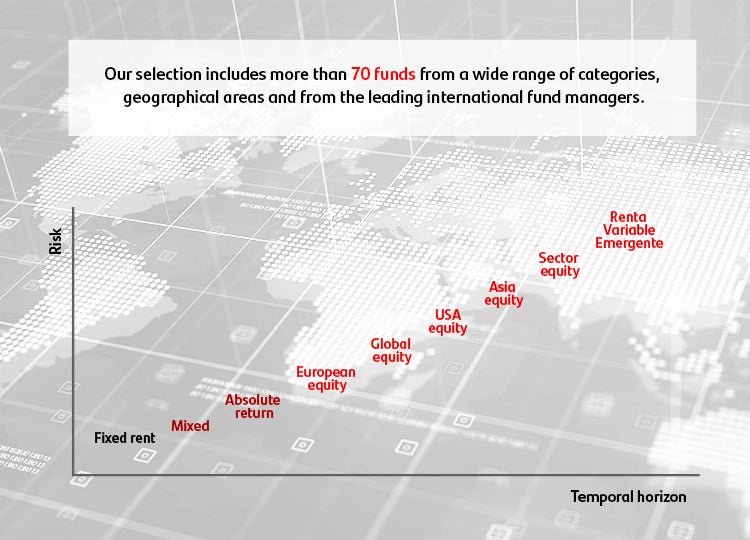

- More than 70 investment funds in all categories.

- Diversification in different geographical areas.

- Variety of asset types.

More than 70 investment funds

In order to help you diversify your investment, in Banco Santander we offer you a wide range of funds from managers other than ours for you to compare and choose with which assets you can best complete your investment portfolio.

How does this service work?

Our team of experts analyses the investment funds from international management entities and the soundness of their investment processes and the strengths of their management teams based on qualitative and quantitative criteria.

Thanks to this analysis, Banco Santander is able to offer you more than 70 investment funds from a wide range of categories and geographical areas, from leading international fund managers so that you can choose the ones that best suit your investment needs.

You can make your own selection using the Fund Search Engine and filtering according to your needs:

- Asset type

- Currency

- Geographic area

- Risk level

- Management Company

- Profitability

- Rating

- Fees

Characteristics

The funds that Banco Santander offers you have been carefully selected by our team of analysts and they meet rigorous standards in investment and management processes.

The funds of third-party managers also offer features common to our entire fund offering:

- Liquidity: you can have the amount you need almost immediately.

- Taxation: the funds are exempt from capital gains tax until they are redeemed for individuals residing in Spain.

- Diversification: the risk is spread among different financial assets to protect the investment.

- Transparency: All the information you need to understand where you are investing your money is in the Fundamental Data for the Investor document.

Risks of investment funds of third-party management companies

Los fondos de inversión son productos que dependen de las fluctuaciones en los precios del mercado y otras variables por lo que la inversión en estos activos implica asumir determinados riesgos:

- Credit risk: due to the quality of the assets in which it invests, as well as its issuers.

- Market risk: the market risks are:

- Interest rate risk: both price variations and the duration of the portfolio affect fixed income assets.

- Exchange rate risk: Exchange rate fluctuation for assets denominated in currencies other than the reference interest rate.

- Due to investment in variable income assets: Derived from variations in the share price.

- Due to investment in emerging markets.

- Due to investment in derivative financial instruments: operations are carried out with options on portfolio securities.

- Liquidity risk: this may adversely affect the liquidity of the fund and/or the price conditions at which the fund may be forced to change its positions.

How to arrange cover

If you are already a client, discover the selection of funds from third-party management entities that Banco Santander offers you through our investment platform SO:FIA. If you are not yet a client, discover the advantages of being a Banco Santander customer.

If you want more information you can contact us at your nearest Santander office.

Know the available assets

These are the types of assets available to you when contracting third-party funds:

- Monetary and Fixed Income. These funds invest in bonds and obligations issued by states and/or private companies. This type of investment allows you to choose from very short terms to longer terms and is suitable for clients who do not want to take a high risk.

- Mixed/Profiled. These are funds that combine fixed and variable income in different proportions depending on the fund. You can choose more or less risk according to your investment objectives and can use them as a sole investment as they are widely diversified.

- Variable Income. These are funds that invest in the shares of various companies. In general, the risk is higher than for fixed income funds but, in return, they offer potentially higher returns. They allow us to cover the various geographical areas and special topics.

- Sector funds. Within the variable income funds we can choose special themes and the sectors that best fit the market moment.

- Absolute Return/Alternative. These funds seek to obtain positive returns, regardless of market conditions. Very different techniques are used and they are very useful to complement the portfolios and reduce their risk.

The best international management funds selected by analysts from Santander Asset Management and Santander Private Banking.

Investment funds are products that depend on fluctuations in market prices and other variables. The value of units can go up as well as down, therefore, the recovery of the initial capital invested cannot be guaranteed, Past results are not a reliable indicator of future returns.

Investment funds involve certain risks (market, credit, liquidity, currency, interest rate, etc.), which are all detailed in the Simplified Prospectus or document that replaces it in the State of origin of the investment fund (in the case of funds established in Spain, the Fundamental Data for the Investor (DFI) document). The nature and scope of the risks will depend on the type of fund, its individual characteristics, the currency and the assets in which the equity of the fund is invested.

Consequently, the choice between the different types of funds must be made taking into account the investor's appetite and ability to take risks, as well as their expectations of future returns and their investment time horizon. Before subscribing to units of a fund, the investor should consult the information contained in the Prospectus and in the Simplified Prospectus or document that replaces it, both documents being available to investors at our offices and at the Management Company of the investment fund, and in the case of funds constituted in Spain, the National Securities Market Commission (CNMV).

The taxation of the income obtained by the participants will depend on the tax legislation applicable to their personal situation and may vary in the future.

This information is of an advertising nature and is disseminated exclusively for informational purposes. Its content does not constitute the basis of any contract or commitment, nor should it be considered as investment advice or a recommendation of any kind.

Third-party investment funds

- More than 70 investment funds in all categories.

- Diversification in different geographical areas.

- Variety of asset types.

Other related products

Equity Funds

Funds that invest mainly in shares of companies in various sectors and geographic areas.

Mixed Funds

Invest in fixed and variable income assets and maximise the diversification of your investment.

You might be interested in

Santander Blog

What is financial risk diversification?

Dictionary

What is a fund manager?