Companies

Currency forwards

Minimise the risks that come with transactions in different currencies. By trading in FX forwards you will have a guaranteed price to protect you from market fluctuations.

Protection against transactions made in different currencies

You love that your company operates abroad, but that forces you to work with different currencies and the exchange rate can sometimes affect your figures.

Have you considered how you can reduce the impact of currency fluctuations on your company's income statement?

We support you in your international venture, offering you digital solutions and specialised teams to help you control the financial risks associated with your international receipts/payments in a currency other than the Euro.

Controlling exchange rate fluctuations in your foreign trade dealings has never been easier because:

- You canarrange your currency transactions online (24 hours, Monday to Friday):

- With real time enforceable prices for spot and forward foreign exchange trading in more than100 currency pairs

- With the possibility of fixing an exchange rate for your future transactions, and programming smart orders which are carried out when the exchange rate reaches the value you are waiting for.

- It offers you current market information so that you can keep up to date and predict any possible effects on your profit and loss account. As well as following trends in currency prices that your business deals are exposed to.

- It allows you to manage your positions and events and to keep track of all your currency transactions and to set up alerts on prices, orders executed, documentation pending signature, etc.

- It provides you with a simple, complete and unique tool that will give you the autonomy and peace of mind you have been looking for to keep the effect of currencies on your bottom line under control.

Options and types of coverage

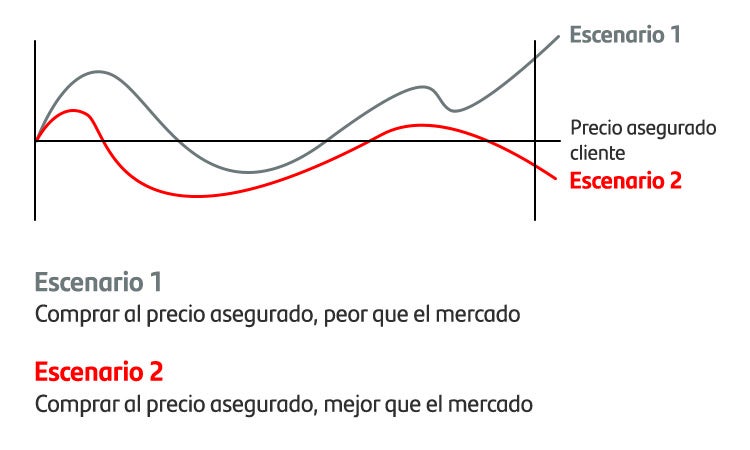

To minimise the risk derived from the exchange rate, we guarantee single FX price at a certain date. In this way, you have a fixed price at maturity, regardless of market’s movements. This makes managing currencies other than euros easier, as you know the costs or revenue from your transaction or investment right from the beginning and you can forget about doing calculations.

- Choose currency forwards if you want to have a fixed trade price at maturity so that the change in the currency price does not affect you. This can be used before maturity by modifying the initial contracted price.

- Choose the American-style currency forward if you are interested in setting an exchange rate for the sale during a certain period, from the start date you need and until the maturity of the operation, so that you can always use the same price during that period.

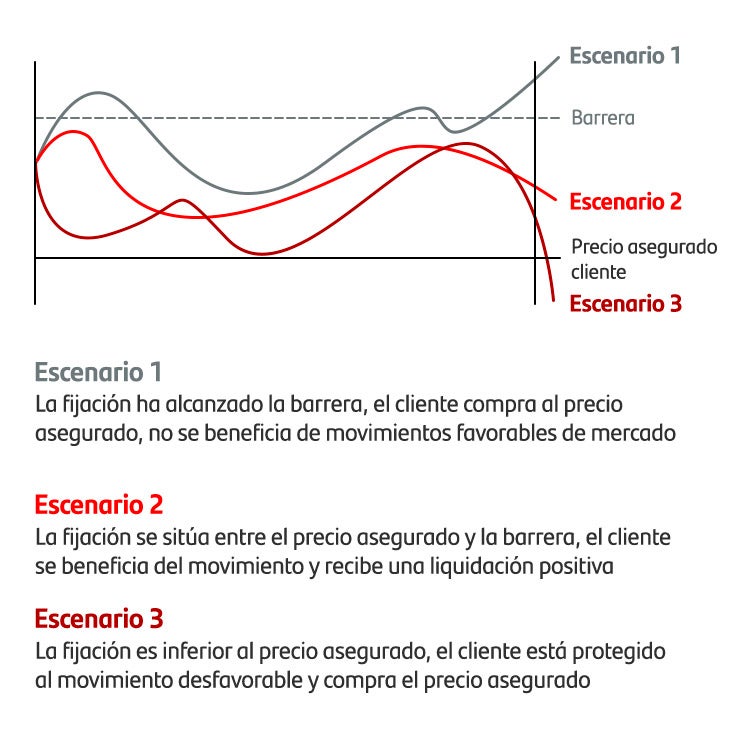

In the case of currency forwards with settlement, we continue to offer you a single price at maturity for a period of time, but we set a barrier, in such a way that you benefit from all the positive movements of the market until you reach that barrier. Therefore, if the market price is set above the level of the determined barrier, you lose nothing.

The barrier can be:

- European: observed only on the maturity date.

- American: observed continuously throughout the life of the operation.

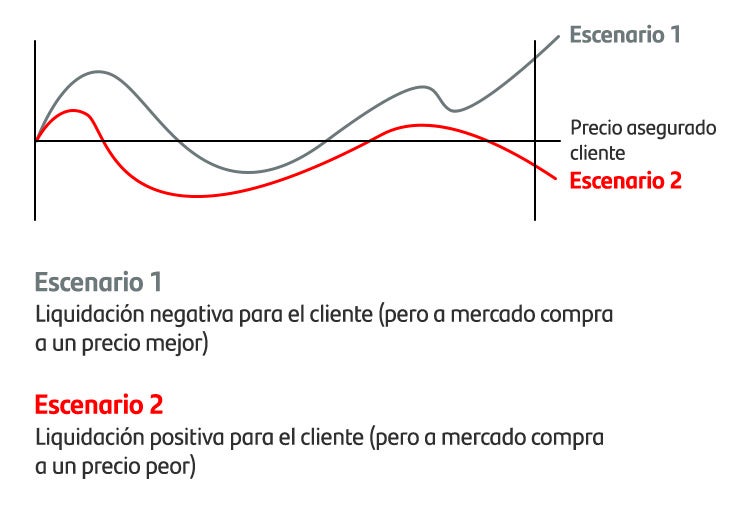

With an NDF, you eliminate the exchange rate risk of non-deliverable currencies, in other words, there is no physical delivery of currencies as they are only used within the country to which they belong, such as the Chilean peso, and are settled based on the exchange rate differences.

On the maturity date, we look at the difference between the contracted price and that set by the Central Bank of the corresponding country and you get a positive or negative settlement on the account, which will be offset by the price of the physical exchange of the currency in the given country.

List of deliverable and non-deliverable currencies

Deliverable currencies

AUD

GBP

CAD

CNH

DKK

HUF

MAD

NOK

SEK

TRY

USD

NZD

BGN

KWD

CHF

Australian Dollar

Pound Sterling

Canadian Dollar

Renmimbi in HK

Danish krone

Hungarian forint

Moroccan dirham

Norwegian krone

Swedish krona

Turkish lira

American dollar

New Zealand dollar

Bulgarian Lev

Kuwaiti dinar

Swiss franc

CZK

HKD

JPY

MXN

PLN

SAR

SGD

ZAR

RON

AED

QAR

INR

ILS

HRK

TND

Czech krona

Hong-Kong dollar

Japanese yen

Mexican peso

Polish zloty

Saudi Riyal

Singapore dollar

South African rand

Romanian ron

United Arab Emirates dirham

Qatari riyal

Indian rupee

Israeli shekkel

Croatian kuna

Tunisian dinar

Deliverable currencies: Australian dollar, pound sterling, canadian dollar, renmimbi in hk, danish krone, hungarian florin, moroccan dirham, norwegian krone, swedish krona, turkish lira, american dollar, New Zealand dollar, bulgarian lev, kuwaiti dinar, swiss franc, czech krona, Hong Kong dollar, japanese yen, mexican peso, polish zloty, Saudi riyal, Singapore dollar, South African rand, romanian ron, United Arab Emirates dirham, qatari riyal, indian rupee, israeli shekkel, croatian kuna, tunisian dinar.

Non-deliverable currencies

ARS

BRL

CLP

COP

PEN

IDR

PHP

TBH

MYR

CNY

Argentine peso

Brazilian real

Chilean peso

Colombian peso

Peruvian Sol

Indonesian Rupiah

Philippine Peso

Thailand Bath

Malaysian Ringgit

Yuan Renmimbi

Non-deliverable currencies: argentine peso, brazilian real, chilean peso, colombian peso, peruvian peso, indonesian rupiah, philippine peso, Thailand bath, malaysian ringgit, yuan renmimbi.

How can it be opened?

The conditions of this product are personalised for each customer. You can find out more about them through electronic banking, at your Santander branch or from the specialists at the International Business Centre.

You can request this product at any of the Santander branch offices with the support of an international business manager, via Online Banking or by contacting the Comex Specialist Centre on 91 600 99 00.

1. Operations subject to prior approval by the Bank.