1 / 6

This number is indicative of the risk of the product, being 1/6 indicative of lower risk and 6/6 of higher risk.

Banco Santander is attached to the Credit Institutions Deposit Guarantee Fund. For money deposits the maximum guaranteed amount is 100,000 euros per depositor in each credit institution.

Accounts

Business Account, also for self-employed

No maintenance fee for the account and no terms and conditions: no need to set up direct debits, bills or receive a minimum amount of payments. Your account has no fees and you will receive several benefits.

Learn about the advantages of the Business Account for self-employed

No fees or conditions available to multiple cardholders

It has no maintenance fee and no requirements: no income, no receipts, and no permanence.

POS for card payments 1

Arrange a POS for your physical shop, online business or to sell on social media.

You can receive help online, over the phone or by visiting a branch.

Debit card with accident insurance

There are no issuance or maintenance fees and it includes accident insurance of up to €120,0002.

Available as soon as your account is opened, without needing a physical card.

The Business Account for the self-employed with no fees where you will benefit from…

Free transfers in the following cases:

- All the ones you make in euros online or at ATMs, whether standard or immediate, but not the urgent ones.

- To any bank in the UK, Poland and Portugal, even if it is not Santander, and whether you do them online or in a branch. The currency exchange fee is not exempt, when applicable.

Free cash withdrawals using debit cards:

Withdraw cash on debit with no fees from any of the 30,000 Santander ATMs worldwide or the more than 6,000 across Spain.

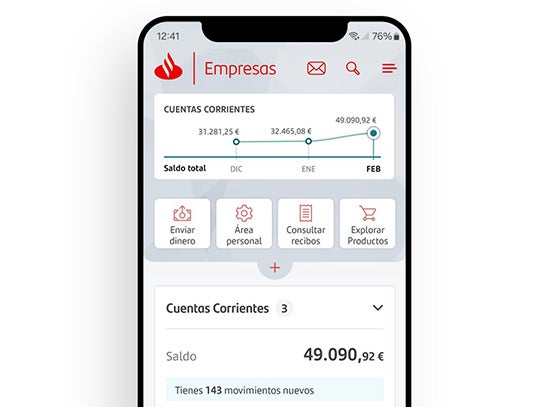

All your accounts in a single place:

- Manage all of your bank accounts in a single app, without having to use third-party apps.

- View your income and expenses, by period or category.

- Receive messages with tips to manage your finances, thanks to the financial assistant.

How can you open a Business Account in just a few minutes?

1

Enter your details

Fill in the form with your details, such as your full name, Spanish national ID document (DNI), contact details and address.

2

Confirm your identity

Using the options that we offer for this process. If you choose to do this by video, we will request access to your camera.

3

Read and accept the contract terms and conditions

The General and Specific Terms and Conditions, using the signature that we will provide to you.

Open an account today

If you have already started the process of opening an account, you can continue here.

FAQs about the account for the self-employed

Before signing up for the account, it is important that you carefully consult and review these documents:

- Pre-contractual information: which describes how the account works and its characteristics. You'll find the most important things highlighted in bold.

- Fees information document: includes the fees to be paid for the most common services associated with the account.

The Business Account is a non-interest bearing current account3 with no maintenance fees (0% NIR, 0% AER) and no terms and conditions. Individuals who are tax residents of Spain and over 18 years old.

You can request a credit card4 with no issuance or maintenance fees.

With your credit card you can pay for purchases you make abroad in a currency other than the euro with the commission for purchases in non-euro currency exempt.

Discover all our products and services for the self-employed

With your Business Account, you can arrange any products from our financial offer you may require4.

Save for the retirement you want

Simplified employee pension plans for the self-employed5

Increase your tax deduction from €1,500 to €5,750.

From €500

Loan for paying taxes online

Finance the payment of taxes such as VAT, Personal Income Tax or Corporate Tax and manage your cash flows.

Open an account today

If you have already started the process of opening an account, you can continue here.

1. POS service, marketed by Banco Santander, S.A. offered and subject to prior approval by Getnet Europe, Entidad de Pago S.L.U. Getnet, Europe, Entidad de Pago S.L.U., safeguards the funds received from users by deposit in a separate account opened at Banco Santander S.A.

2. This contract has been concluded with the mediation of Santander Intermediación Correduría de Seguros, S.A. According to the conditions of the policy. Registered in the Special Registry of Insurance Brokerage Companies, with code J-989. Civil Liability and Financial Capacity covered by current legislation.

3. Non-interest-bearing account, 0% NIR, 0% AER.

4. Transaction subject to prior approval by the bank.

5. Managing Entity: Santander Pensiones, S.A. EGFP; Depositary Institution: Caceis Bank Spain S.A., S.A.; Promoting entities: Spanish Confederation of Travel Agencies (CEAV), Spanish Confederation of Associations of Young Entrepreneurs (CEAJE), Official College of Social Graduates of Alicante, Federation of Associations of Journalists of Spain (FAPE), Association for the Complementary Social Welfare of Employees of the Santander Group. You have at your disposal the General Information Document, as well as all the detailed information on Sustainability, in www.santanderassetmanagement.es. Pension plans are products that depend on fluctuations in market prices and other variables, so the plan does not guarantee any returns.

Business Account for the self-employed

- €0 maintenance fees.

- No conditions: no receipts, no self-employed fee, nothing.

- Exclusively for new customers.

Other related products

Car renting

If you need a car, you can get one without a big impact on your cash flows through renting.